The smart Trick of Summitpath Llp That Nobody is Discussing

The smart Trick of Summitpath Llp That Nobody is Discussing

Blog Article

An Unbiased View of Summitpath Llp

Table of ContentsHow Summitpath Llp can Save You Time, Stress, and Money.Summitpath Llp Things To Know Before You BuyUnknown Facts About Summitpath LlpSummitpath Llp - QuestionsExcitement About Summitpath LlpSee This Report on Summitpath LlpThe Ultimate Guide To Summitpath Llp

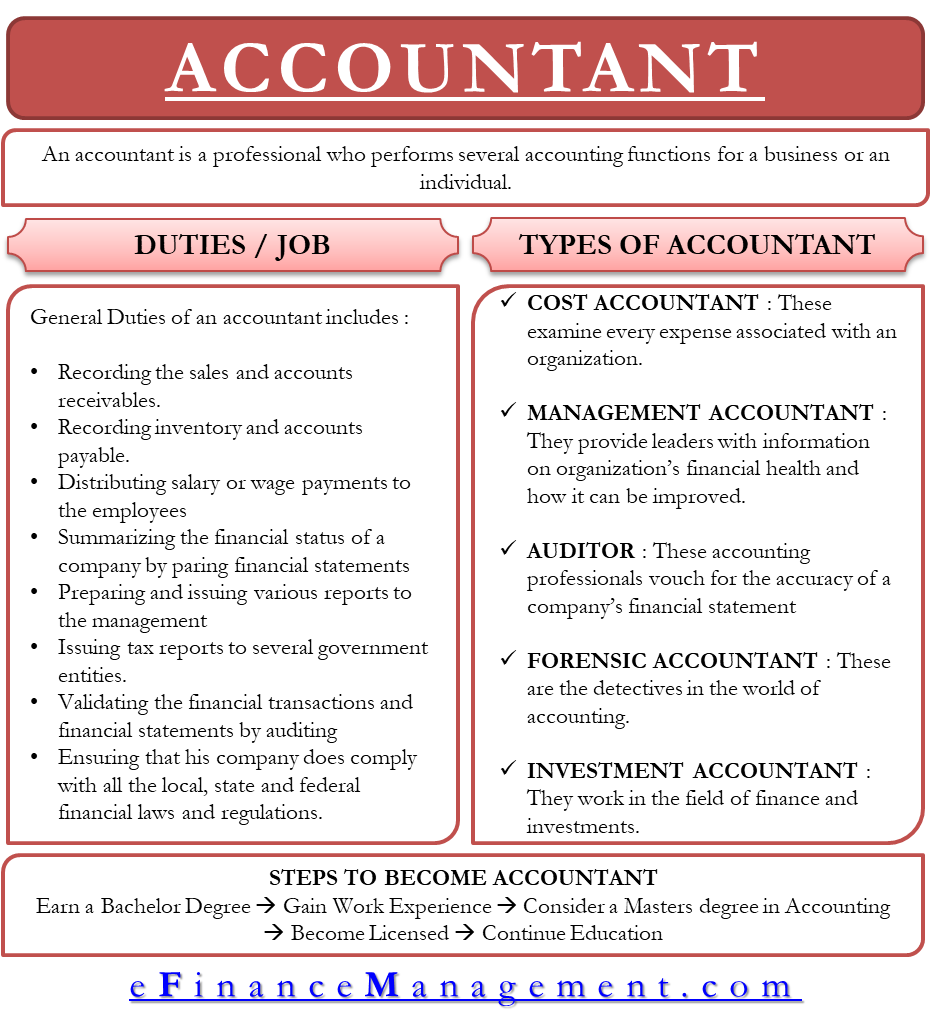

Improvement in the field can take many kinds. Entry-level accountants may see their duties boost with every year of technique, and this might qualify them to move right into monitoring positions at greater wages. Accounts in elderly supervisor, leadership or exec duties usually will need a master's level in accountancy or a master's of service management (MBA) with a concentrate on accountancy.Below is a sampling of specializeds they can pursue: Assist individuals make choices about their money. This can include advising them on tax laws, investments and retired life planning. Maintain delicate monetary details private, frequently collaborating with IT professionals to shield innovation networks and protect against safety and security violations. Identify the worth of assets, with the assessments used for monetary filings or sale of the properties.

Monitoring accounting professionals usually start as expense accounting professionals or jr inner auditors. They can advance to bookkeeping supervisor, primary cost accounting professional, budget director or manager of inner auditing.

Summitpath Llp Can Be Fun For Anyone

There are several accounting levels. The most affordable, an associate degree in bookkeeping, will qualify you for clerical duties under an accounting professional. There are 5 typical sorts of accountants. For these duties, you'll require at least a bachelor's level and to come to be a licensed public account (CPA), a credential that you can make after you complete your level.

A monitoring accounting professional is an essential function within a service, yet what is the duty and what are they expected to do in it? Working in the accountancy or finance department, monitoring accountants are responsible for the prep work of monitoring accounts and several various other records whilst likewise looking after basic audit treatments and techniques within the business.

All about Summitpath Llp

Evaluating and taking care of danger within the service. Monitoring accounting professionals play an extremely crucial role within an organisation. Trick monetary information and records produced by monitoring accounting professionals are utilized by elderly administration to make informed organization decisions. The analysis of organization efficiency is a crucial role in a monitoring accounting professional's job, this evaluation is produced by taking a look at present financial info and also non - monetary data to figure out the position of business.

Any type of company organisation with a financial division will certainly require an administration accounting professional, they are additionally regularly employed by banks. With experience, a monitoring accounting professional can expect solid profession development. Specialists with the called for credentials and experience can go on to become financial controllers, finance directors or chief financial policemans.

Can see, evaluate and advise on alternative resources of organization money and various methods of increasing money. Communicates and suggests what influence monetary decision making is carrying advancements in policy, principles and governance - https://peterjackson.mee.nu/where_i_work#c2654. Assesses and suggests on the right methods to take care of company and organisational performance in regard to service and finance risk while interacting the influence effectively

The Only Guide for Summitpath Llp

Advises the ideal methods to make sure the organisation sticks to administration frameworks and applies finest method inner controls. Makes use of threat monitoring methods with the finest interests of the firm and its stakeholders in mind.

Makes use of different innovative methods to apply approach and handle change. The difference in between both monetary bookkeeping and managerial audit worries the designated customers of info. Managerial accounting professionals call for company acumen and their objective is to work as service partners, aiding service leaders to make better-informed decisions, while economic accountants intend to create economic papers to supply to exterior parties.

An understanding of organization is likewise important for monitoring accountants, along with the capacity to interact successfully in all levels to encourage and liaise with senior participants of team. The responsibilities of a monitoring accountant need to be carried out with a high level of organisational and strategic reasoning abilities. The typical wage for a chartered administration accountant in the UK is 51,229, a boost from a 40,000 ordinary earned by administration accounting professionals without a chartership.

How Summitpath Llp can Save You Time, Stress, and Money.

Generous paid pause (PTO) and company-observed vacations. Professional advancement opportunities, including repayment for CPA accreditation prices. Versatile job alternatives, including crossbreed and remote timetables. Access to wellness programs and staff member assistance resources. To use, please send your resume and a cover letter outlining your credentials and passion in the senior accountant function.

We're eager to locate an experienced senior accounting professional ready to contribute to our business's financial success. HR call details] Craft each section of your job summary to mirror your company's special needs, whether hiring an elderly accounting professional, business accountant, or another professional.

The "Concerning United States" section sets the tone for your work posting and offers a peek into your company's culture. Customize this area to stress high qualities accounting experts prioritize, such as honesty, accuracy, and career advancement. : We're a relied on leader in financial solutions, dedicated to precision and advancement. Our accounting group prospers in a supportive and joint atmosphere, with accessibility to sophisticated innovation and continuous discovering chances.

Summitpath Llp Things To Know Before You Buy

A solid accountant task profile goes beyond noting dutiesit clearly connects the credentials and expectations that align with your organization's needs. Separate in between essential qualifications and nice-to-have skills to help candidates assess their viability for the placement. Define any kind of qualifications that are obligatory, such as a CPA (Cpa) license or CMA (Certified Management Accounting professional) classification.

Adhere to these best practices to produce a work summary that reverberates with the best candidates and highlights the one-of-a-kind facets of the duty. Accountancy roles can differ commonly depending upon seniority and specialization. Stay clear of obscurity by laying out certain tasks and areas of emphasis. "prepare month-to-month monetary statements and oversee tax obligation filings" is far more clear than "manage monetary records."Reference crucial areas, such as economic reporting, bookkeeping, or pay-roll monitoring, to draw in candidates whose abilities match your needs.

Get This Report about Summitpath Llp

Describing accountant job summaries for resume growth is a wise relocation to obtain your innovative juices flowing - tax preparation services. By evaluating the job my response summaries, you can evaluate and make a checklist of what skills and experience you have that align with them. From there, you can integrate them right into your resume

Report this page